Being flooded by an ocean of data is the hard reality of most marketers. You’re preparing reports for the next marketing meeting, and wondering what strategy to implement in order to achieve the ambitious numbers set out by your superiors. Sound familiar?

RFM segmentation might just be the answer to your prayers. Or at the very least, it would make your life a lot easier.

Being “customer-centric” is a term that’s often throws the hard reality of many marketers. You are preparing reports, making presentations for the next man around by many businesses, but how many of them actually live up to their word? With so much emphasis on pushing out content and reporting, it seems many companies have lost touch with the very thing that makes their businesses thrive: the customers.

Knowing your customers and their spending habits is key to the growth of your business. That is where the RFM model will prove so valuable.

What is the RFM model?

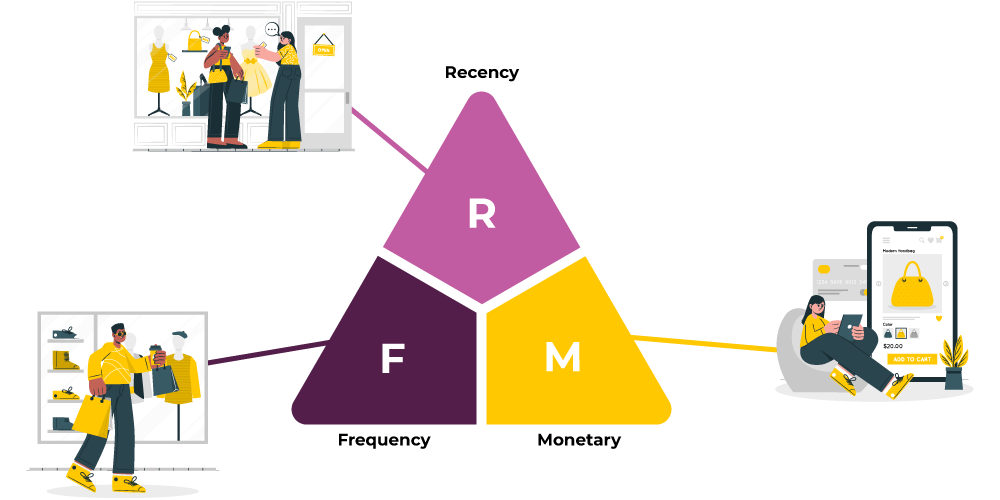

The RFM model is a proven marketing strategy based on customer behavior segmentation. It divides customers based on their purchase history – how Recently, with what Frequency, and what Monetary value they purchased. Today, the RFM model is widely used and helps businesses optimize their marketing efforts throughout various channels.

What is RFM (recency, frequency, monetary) analysis?

RFM analysis is a marketing technique used to rank and group customers based on the Recency, Frequency and Monetary value of their recent purchases.

It allows you to identify your most loyal customers, your big spenders, and your less active customers, so you can create tailor-made campaigns for each category.

The system assigns each customer numerical scores – typically from 1 to 5 – based on these 3 factors to provide an objective analysis.

RFM analysis rates each customer on the following factors:

So, how does RFM analysis work?

RFM analysis gives each customer various scores based on each of the 3 main factors. In general, a score from 1 to 5 is given, with 1 being the lowest and 5 being the highest.

The collection of the 3 values for each customer is called an RFM cell. In a simple system, RFM analysis averages these values together, then sorts customers from highest to lowest to find the most valuable customers. Some businesses, instead of simply averaging the three values, weigh the values differently.

Take my previous example of a car dealership, a fashion brand and a food delivery service ranking their variables differently. A car dealership may recognize that an average customer is highly unlikely to buy several new cars in a time period of just a few years. But a customer who does buy several cars – a high-frequency and high-monetary value customer – should be highly regarded.

So, the dealership may choose to weigh the value of the frequency and monetary score accordingly. For fashion brands the expected purchase frequency may vary depending on whether they are a fast fashion or a premium brand.

Fast fashion brands may calculate with a recency of weeks or even days, whereas premium fashion brands will expand that variable to weeks or even months. As for food delivery services, the recency variable could be reduced to hours, depending on the platform.

Last but not least, businesses that don’t rely on direct payments from customers may use different factors in their analysis.

For example, websites and apps that value audience, number of views or interactions may use an Engagement Value instead of Monetary Value to perform an RFE (Recency, Frequency, Engagement) analysis instead of the standard RFM analysis using the same techniques as mentioned above.

Segmentation of customers in RFM analysis

Here at Glamview we’ve asked ourselves the question: How can we design a segmentation that saves you time, is easy to use, and gives instant visualization to whoever has access to the data?

Our goal was to help you out of your storm of data and give marketers time to take a breath and focus on creating relevant marketing strategies for each customer segment.

In our RFM system we segment 10 different types of customers, but here are 3 examples of customer segmentation that you can create various marketing strategies for:

Why RFM is Effective for Small and Medium-Sized Businesses

For small and medium sized businesses with limited marketing resources, RFM analysis can prove especially useful for the following reasons:

It’s simple to use

RFM analysis does not, on its own, require complex tools or advanced analytical capabilities. There’s no need to hire a data analyst to interpret your data, because the principles are easy to understand and the results are easy to interpret and act on.

It’s affordable

Businesses that use RFM marketing can apply their insights from their RFM analysis and increase their retention rate. Retention is up to 6-7 times cheaper than the acquisition of new customers, as well as an excellent way to maximize the longevity of your business.

It’s effective in direct marketing

RFM analysis, which has a history of database marketing and direct mail marketing, has been shown to be effective with relatively inexpensive digital direct marketing strategies that smaller brands can afford, such as an email marketing campaign.